In the beginning of our relationship, my husband and I had no budget in place for our small family. We had just finished college, had a baby, and were working off one, entry-level income. What seemed like a decent-sized paycheck for us recent graduates also seemed to always vanish before the end of the month on our basic necessities. We weren’t spending frivolously by any means, but the monthly costs of our townhome, utilities, baby supplies, and groceries seemed to wipe each paycheck every month. By utilizing a budgeting app, we were able to visually identify the high areas of spending in our family and make necessary adjustments in order to save more effectively.

My Go-To Budgeting App

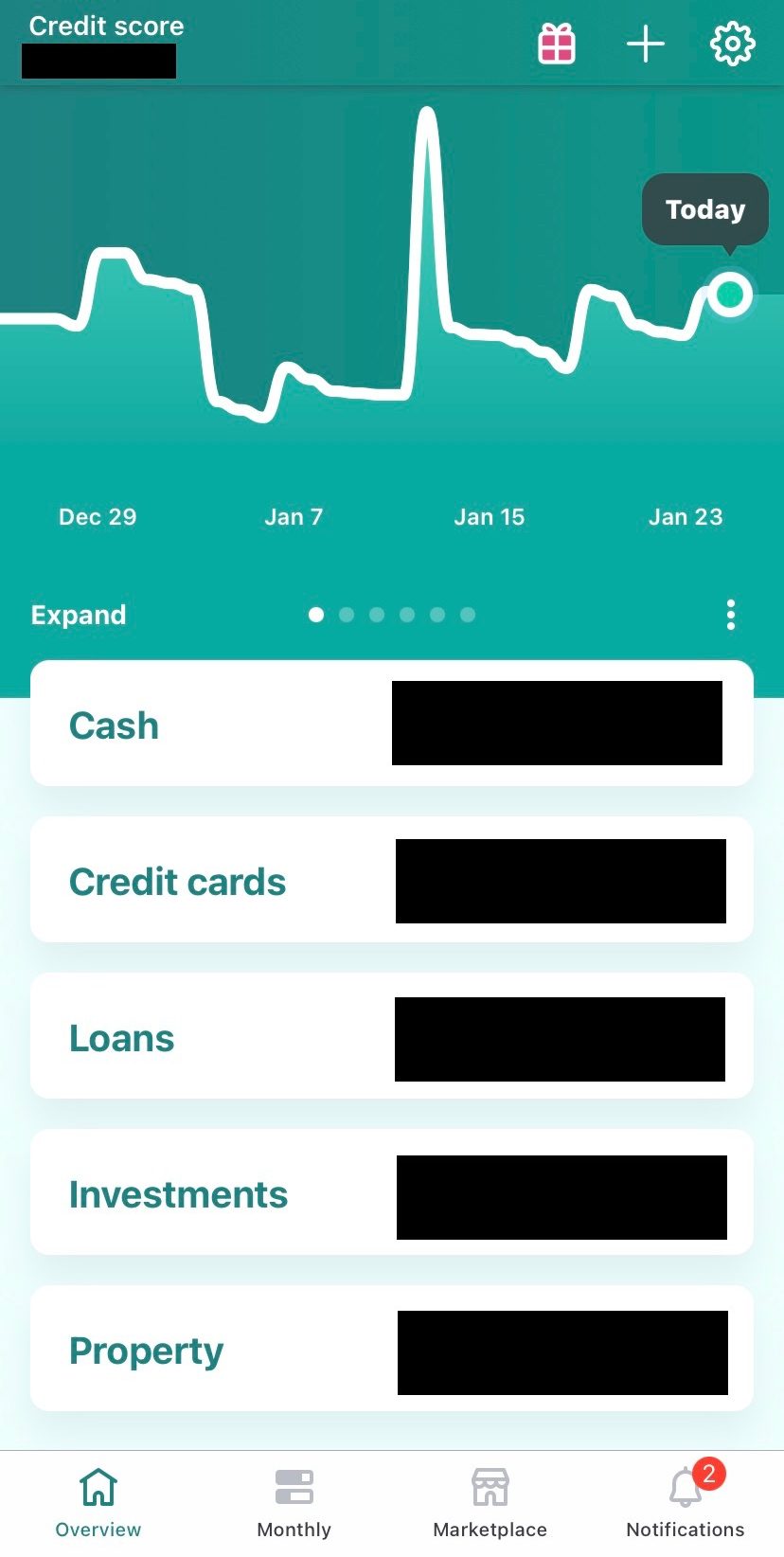

Technology has come a long way over the past decade, so much so, that even an Excel spreadsheet can be deemed an outdated budgeting tool. Budgets are constantly evolving depending on the season due to holiday expenses or family vacations. Not to mention, income can vary from month to month as well. After some trial and error, I have finally found the perfect budgeting app for our family. Mint by Intuit, the maker’s of TurboTax, is a revolutionary way to track income and expenses. By linking your bank accounts, credit cards, loans, and assets to your account, you are given a complete, full profile of your family’s overall financial standing. Because your bank accounts are linked to your profile, transactions are automatically categorized into your assigned budget. The app works its best to properly categorize each transaction, but of course, should you need to recategorize an incorrect assignment, you are easily able to do so.

Some Tips and Tricks

- Link All Bank Accounts for the Family

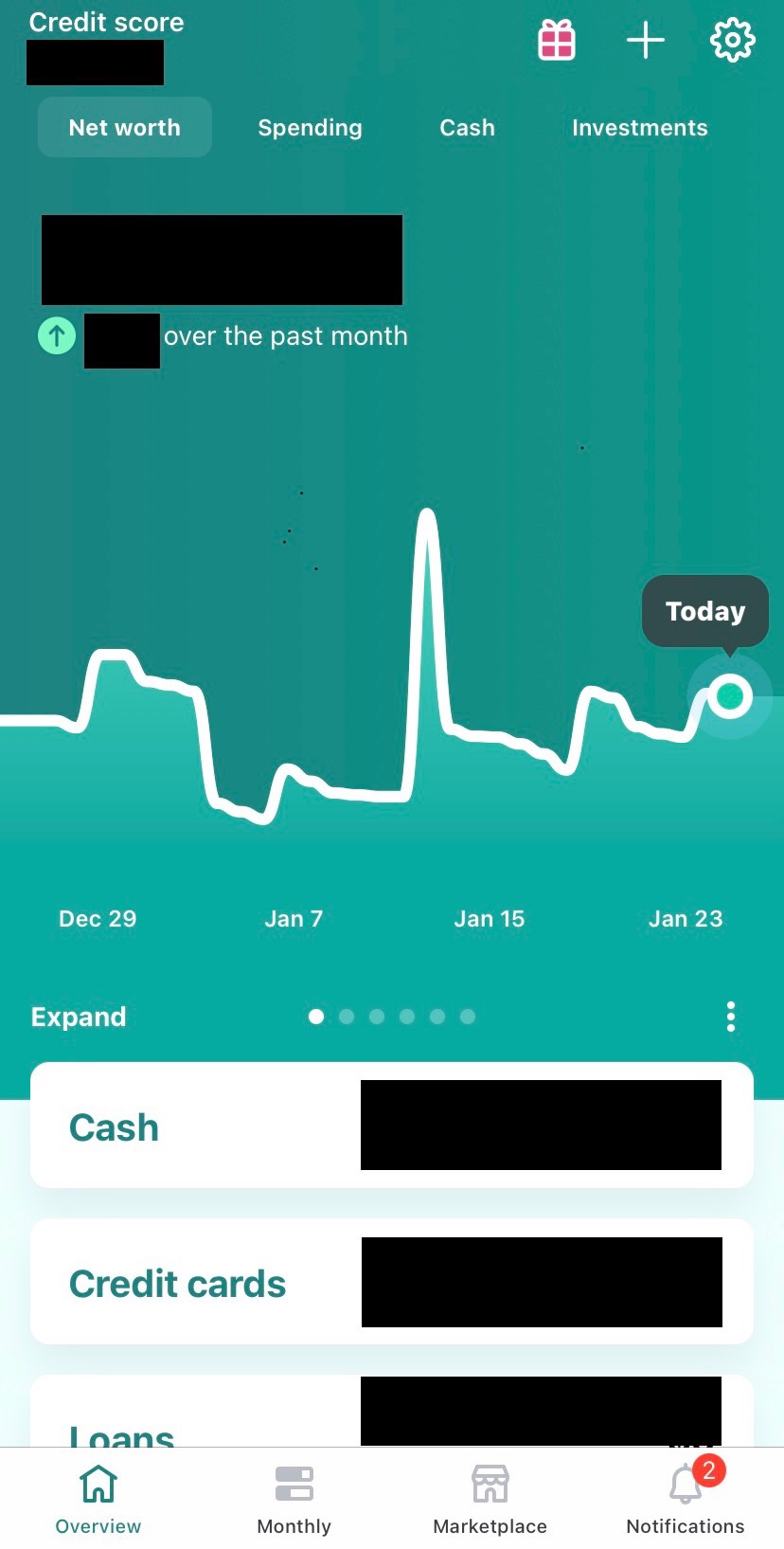

I understand that every family is unique and has different opinions when it comes to joint accounts or individual accounts; however, if you want the best overall picture of your family’s finances, it will be best for you to link all accounts (savings, checkings, assets, retirement, credit cards, loans, and even investing accounts). Adding accounts is easy in the app as most all banking establishments are fully integrated in the app. The app will break down your assets and debt to give you an overall net worth in real-time.

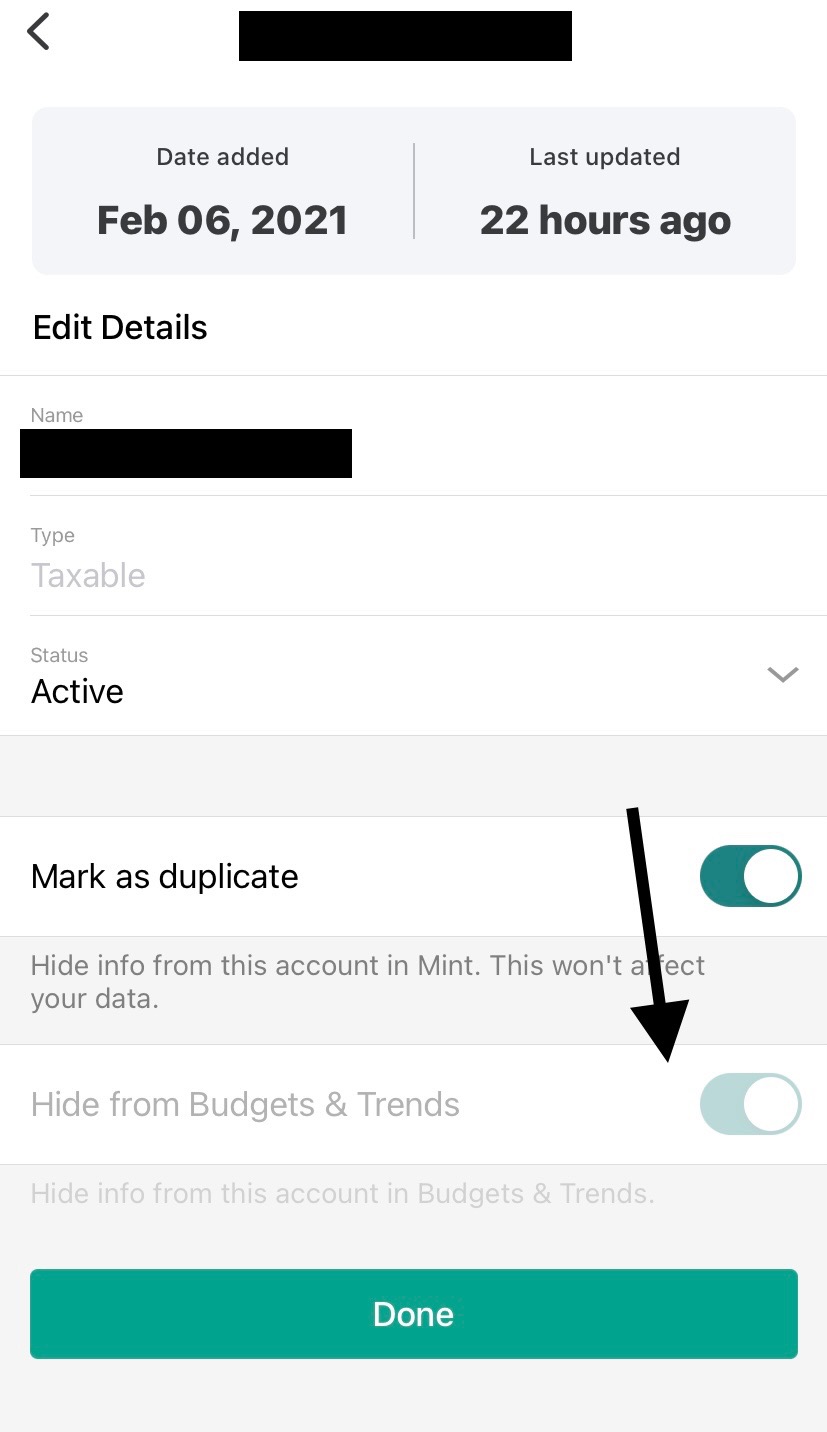

- Hide Any Accounts You Don’t Want To Be Featured in Net Worth

My husband really enjoys dabbling in stock trading through the Webull app, and today’s market is very volatile. Including our investments in the app’s net worth can be confusing to us. Depending on the market for the day, our net worth can look lower or higher than normal, not really giving us an accurate picture since the stock market changes day to day. To avoid any confusion, after adding the Webull account to our Mint app, I used a feature to hide the account from our net worth. Should I be interested in seeing how our investments are doing, I can unhide it temporarily to take a peek.

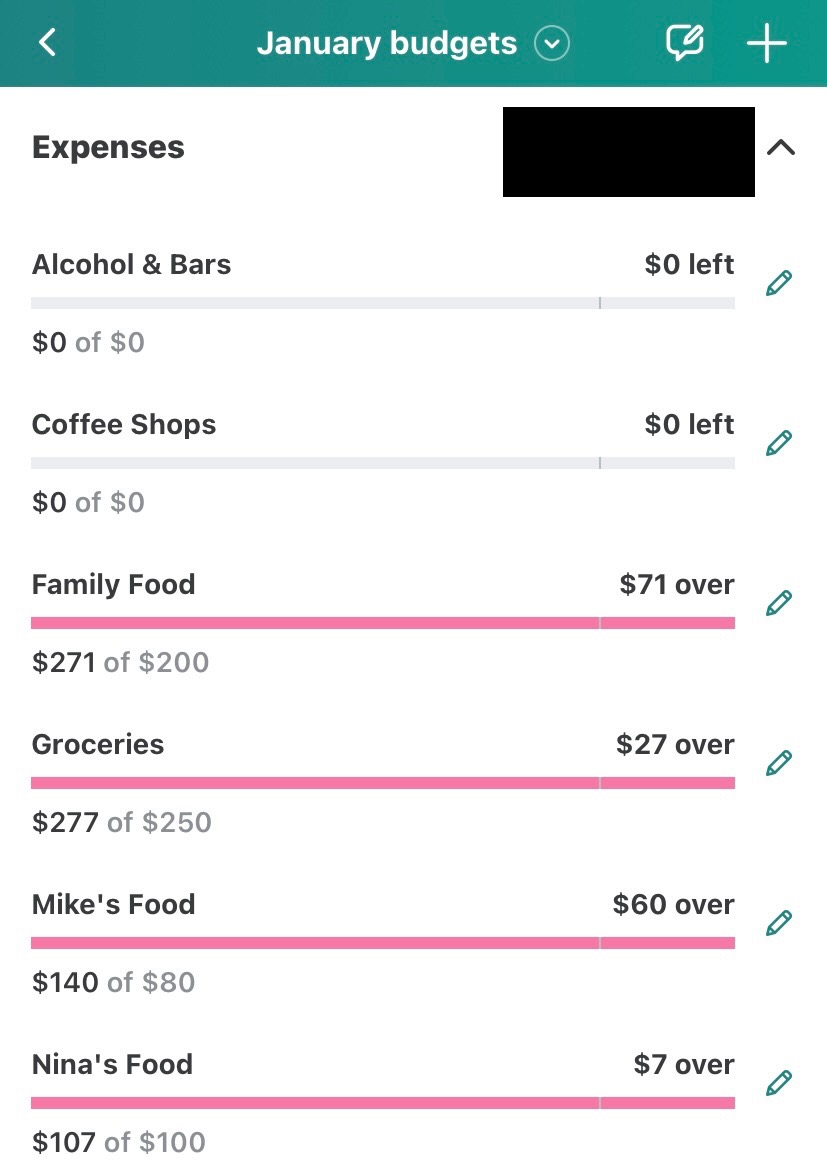

- Set a Realistic Budget

At first, it might seem tempting to set a really strict budget to start saving some serious cash. However, this can easily discourage you after your first month of budgeting if you go over every category you budgeted for. Try to be realistic with your family’s spending habits, and slowly, you can adjust your budget to be stricter.

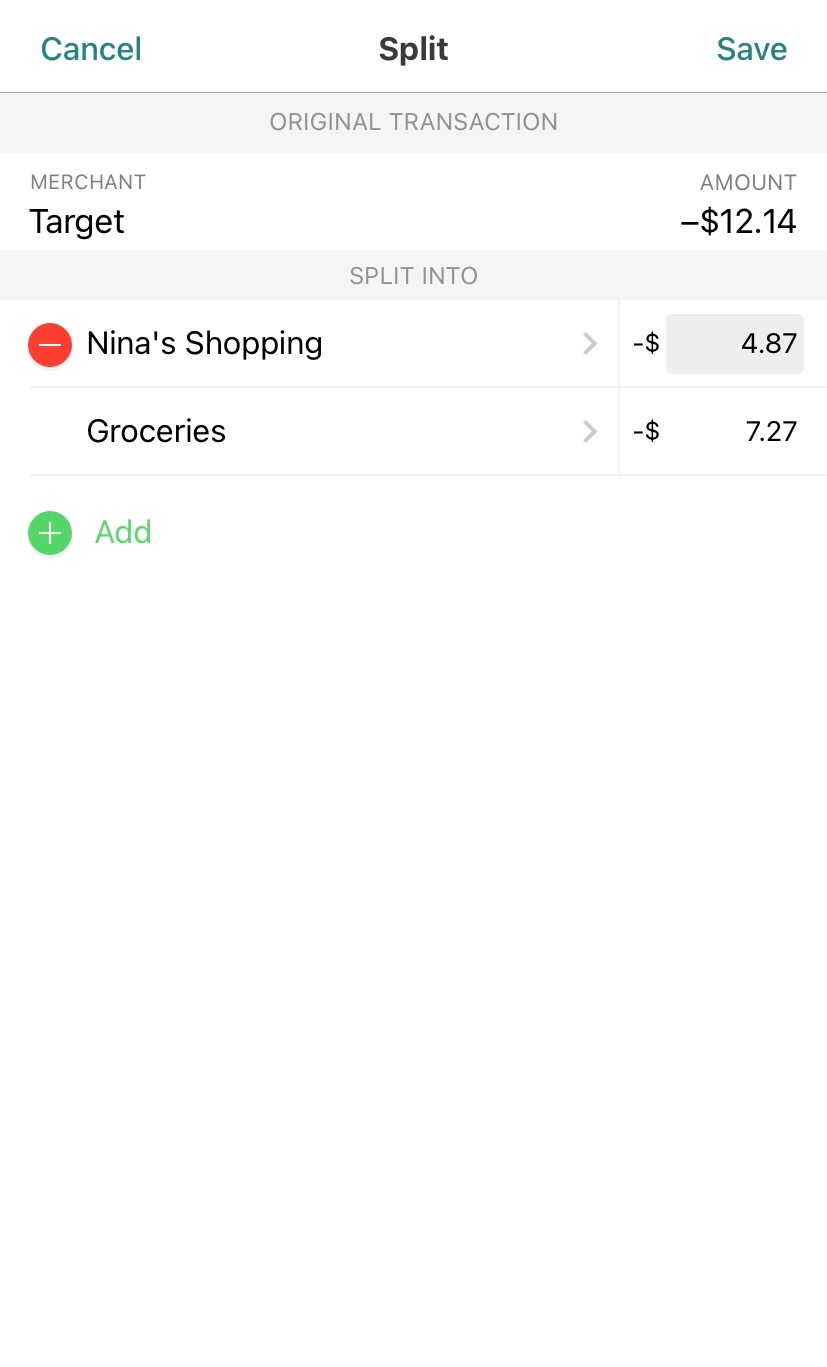

- Split Transactions for Most Accurate Budgeting

At the beginning of my budgeting journey, I would simply categorize transactions by looking at the overall purchase and determining an appropriate category. For example, if I went to Target and bought a majority of groceries along with two, frilly tops, I would mark the whole transaction as groceries. Now, instead, I split the transaction and do the math to figure out how much I spent on the two shirts and then categorize the shirts under my personal shopping budget. This may take some extra work, but it definitely helps your budget, so be sure to hold onto those receipts! And if it helps to mark your entire Target shopping spree as “groceries,” I promise I won’t tell a soul.

- Utilize Unread and Read Feature to Keep Track of Categories

A new feature that I absolutely love is the app’s unread and read feature. I have made it a habit to check my Mint account once a week and go back and double-check that transactions have been categorized properly. Now, when I check again a week later, the app will highlight unread transactions for me so that I know to double-check them. You can also mark read messages as unread should you want to go back to it later.

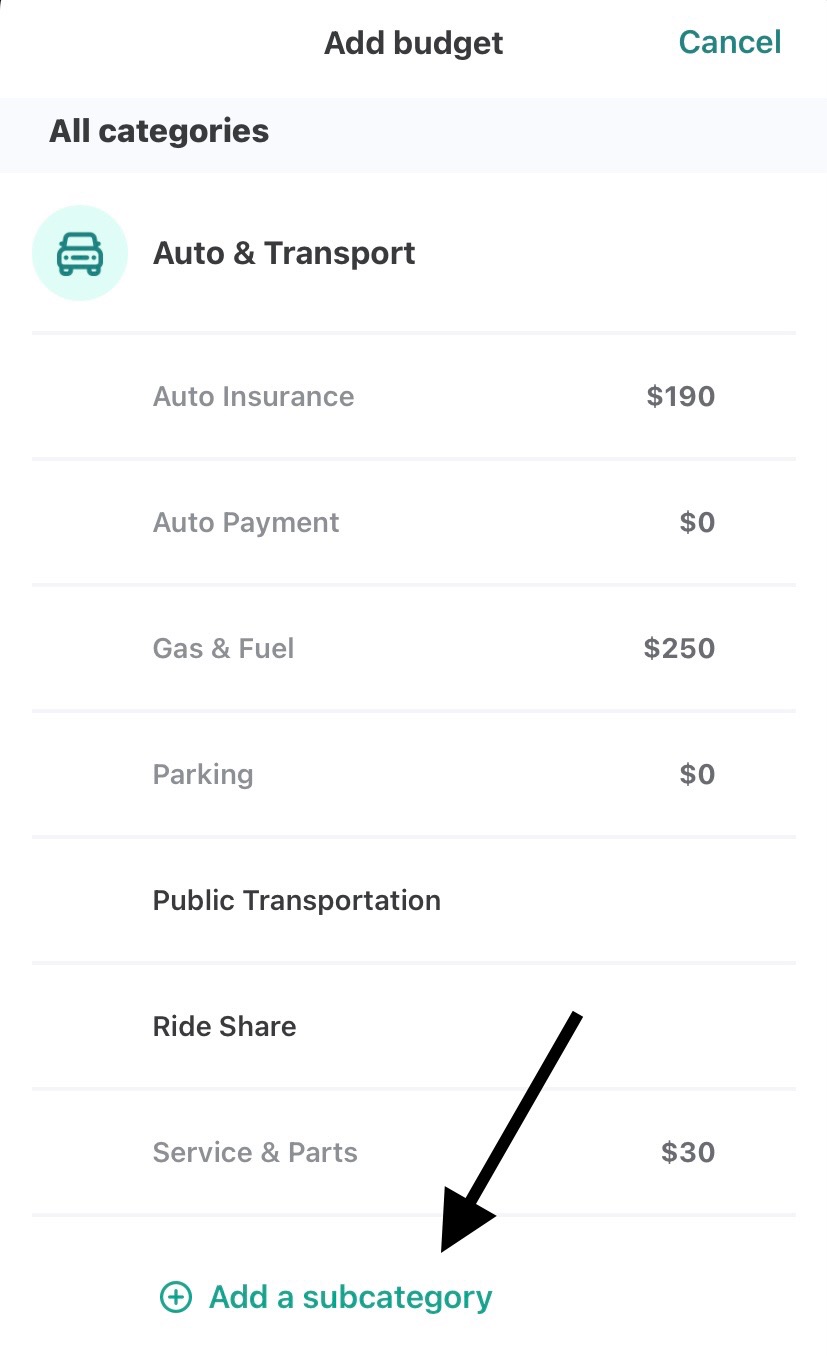

- Add Categories if Necessary

Each family is unique, so should you find yourself missing an important category in the app, you can easily add a category to fit your family’s lifestyle. For example. Instead of using the “Shopping” category for our shopping, I have added his and hers shopping categories so we can accurately track our individual shopping habits.

- Use One Mint Account

One thing that I have noticed the Mint app is missing is the ability to share an account. You must either make an account under your name and email or your partner’s name and email. I would definitely recommend sharing a login as you would have to do all the budgeting twice, should you have two separate accounts. When picking whose name to use, make sure to choose wisely as this person will get all the important emails and their free credit score estimates will be the ones that appear at the top of the app.

This might seem like a lot of work to keep track of expenses, but it has definitely given our family peace of mind when we see our bank account taking a hit, as we can quickly identify the culprit. If not for its budgeting capabilities, at least use this app to monitor your expenses and keep an eye out for suspicious transactions. I promise you, spending a few minutes a week to track your budget will make you feel more accomplished with your time on your phone while also feeling more in control of your spending. And the best part is, the app is completely free!

To use my referral link, feel free to click here.